Investing student loan funds is a controversial yet often debated topic. While student loans are intended for tuition and educational expenses, some students wonder if it’s possible to invest this money and potentially grow their funds. While it’s crucial to understand the risks and limitations involved, there are several investment opportunities that college students can consider. However, it’s important to note that investing student loan money falls into a legal gray area, particularly with government-subsidized loans.

In this article, we will discuss the top investment opportunities in student loan programs. From low-risk savings accounts to higher-risk investments, we’ll cover the options available and explain what students should consider before taking the plunge.

Legal and Financial Considerations

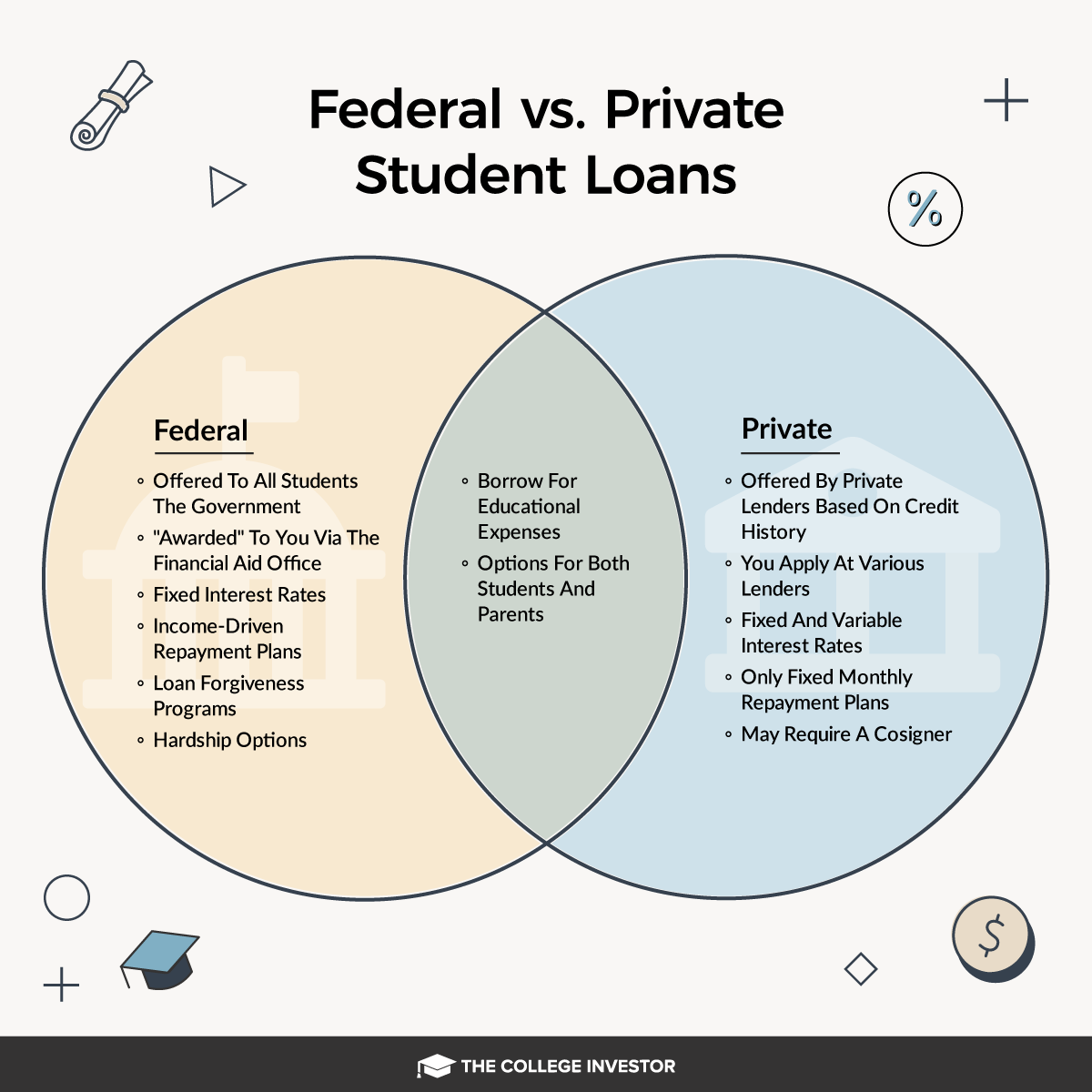

Before diving into potential investments, it’s important to understand the legal implications of using student loan funds for anything other than education-related expenses. Both federal and private student loans have distinct rules governing how the funds can be spent.

Federal vs. Private Loans: Restrictions on Use

- Federal student loans (e.g., Direct Subsidized Loans, Direct Unsubsidized Loans) have strict requirements. These loans must generally be used for tuition, books, and living expenses associated with education. If you use these funds for investments, you could risk violating loan terms, which could lead to serious financial consequences.

- Private loans, on the other hand, tend to offer more flexibility. Private lenders may not impose restrictions on how the money is used, but you should still be cautious when deciding how to allocate these funds.

Investing with student loan money is not advised unless you’re confident in your financial stability and understand the potential long-term consequences. Always consult a financial advisor before making such decisions.

Low-Risk Investment Options

If you’re hesitant about investing but still want to grow your funds, there are low-risk investment options available. These options generally provide a safe way to earn returns without exposing yourself to significant market risk.

High-Yield Savings Accounts

One of the safest ways to earn some return on student loan funds is through high-yield savings accounts. These accounts are offered by many online banks and typically provide much higher interest rates than traditional savings accounts. Some banks currently offer interest rates around 4%, which can help you earn money over time without much risk.

Why Choose High-Yield Savings Accounts?

- Safety: These accounts are FDIC-insured, meaning your money is protected up to a certain limit.

- Liquidity: You can withdraw funds at any time without penalty, making it a good option for short-term savings.

- Simplicity: There’s no need to worry about market volatility or complex investment strategies.

Although the returns are not as high as those offered by stocks or ETFs, high-yield savings accounts are a solid low-risk option for short-term growth.

Guaranteed Investment Certificates (GICs)

Another low-risk option for students is Guaranteed Investment Certificates (GICs). These financial products offer a guaranteed return over a fixed period, making them a safe and reliable investment choice.

- Benefits: You know exactly how much you’ll earn by the end of the investment period, making it a great choice for those who prefer a predictable return.

- Ideal for Short-Term Investments: If you’re planning on repaying your loans soon, GICs can be a suitable option, as they typically have shorter terms (e.g., 6 months to 1 year).

While GICs may not offer substantial returns compared to other investments, they provide the security and predictability that many students need.

Moderate-Risk Investment Options

For students willing to take on a bit more risk for the potential of higher returns, moderate-risk investments might be a better option. These investments come with greater volatility but can still offer significant returns if managed correctly.

Index Funds

Index funds are a popular option for those looking to balance risk and reward. These funds track a market index, such as the S&P 500, and provide diversification by investing in a wide range of companies. This diversification helps reduce the impact of individual stock volatility.

- Benefits: Lower volatility compared to individual stocks, broad exposure to the market.

- Drawbacks: While index funds typically perform well in the long term, they can still fluctuate, especially in the short term.

Index funds are a great way to get exposure to the market without having to pick individual stocks. Over time, they have historically outperformed other investments, making them an appealing option for students who are comfortable with some risk.

Exchange-Traded Funds (ETFs)

Similar to index funds, ETFs offer diversification and are typically less volatile than individual stocks. However, unlike index funds, ETFs can be traded like stocks on the exchange, meaning you can buy and sell them throughout the day.

- Benefits: ETFs are often more liquid than index funds, meaning you can access your funds quicker if needed. They also tend to have lower expense ratios compared to actively managed funds.

- Drawbacks: As with any market-based investment, there’s the potential for short-term fluctuations, though generally less so than with individual stocks.

Investing in ETFs allows you to participate in the stock market with a level of diversification that helps manage risk while providing potential returns.

Robo-Advisors

If you’re new to investing or don’t have the time to manage your portfolio, robo-advisors like Wealthfront or Betterment can help. These platforms use algorithms to create a personalized investment portfolio based on your risk tolerance and time horizon.

- Benefits: Automated, low-cost, and tailored to your investment goals.

- Drawbacks: While robo-advisors are beginner-friendly, they come with some fees, and you have less control over individual investments.

Robo-advisors are a great choice for students who want a hands-off investment strategy but still want to grow their money over time.

Conclusion

In conclusion, investing student loan funds is a decision that requires careful thought and consideration. Federal loans come with strict guidelines on how the funds can be used, so it’s important to fully understand the legal implications before investing. If you’re looking for low-risk options, high-yield savings accounts and GICs offer safe ways to grow your funds with minimal exposure to market fluctuations.

For students willing to take on a bit more risk, index funds, ETFs, and robo-advisors provide moderate-risk options that offer the potential for higher returns. Always make sure to assess your financial goals, risk tolerance, and the timeline for loan repayment before making investment decisions.

Investing in student loans should be done cautiously, with a focus on balancing risk and return. Make sure to prioritize education-related expenses while considering these investment opportunities.

For more information on student loans and how to manage them, visit Federal Student Aid.