Paying for college can be overwhelming, but federal student loans for college offer a reliable solution for millions of students in the United States. These loans are provided by the federal government and come with lower interest rates, flexible repayment options, and borrower protections that private loans often lack. If you’re planning to pursue higher education, understanding your federal loan options is an essential first step in managing your college expenses wisely.

What Are Federal Student Loans?

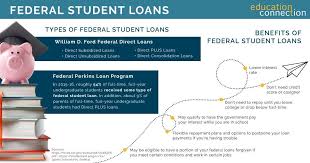

Federal student loans for college are financial aid options provided by the U.S. Department of Education to help students cover the cost of higher education. Unlike private loans, federal loans are regulated by the government, making them more accessible and affordable for most students. These loans are available to both undergraduate and graduate students and are designed to reduce financial barriers to earning a college degree. Key benefits include fixed interest rates, income-based repayment plans, and potential eligibility for loan forgiveness programs.

Types of Federal Student Loans

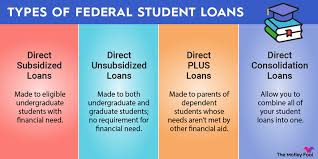

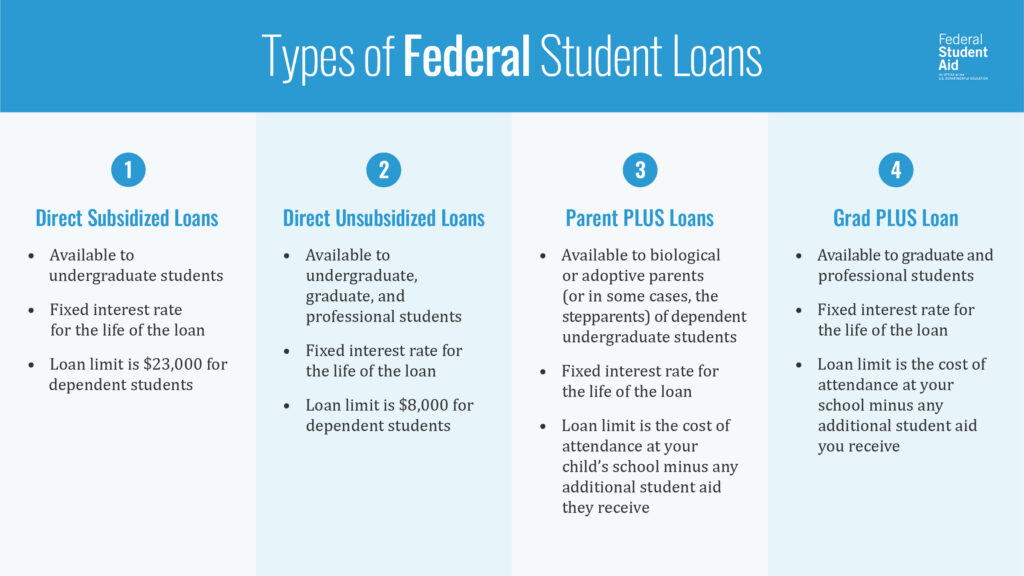

There are several types of federal student loans for college, each designed to meet different student needs:

-

Direct Subsidized Loans: These are available to undergraduate students with demonstrated financial need. The government pays the interest while you’re in school at least half-time, during the grace period, and during deferment.

-

Direct Unsubsidized Loans: Available to both undergraduate and graduate students, regardless of financial need. Interest accrues from the moment the loan is disbursed.

-

Direct PLUS Loans: Designed for graduate or professional students and parents of dependent undergraduates. A credit check is required, and interest begins accruing immediately.

-

Direct Consolidation Loans: Allow you to combine multiple federal student loans into one, simplifying your repayment process.

Each type of loan has unique terms, interest rates, and eligibility requirements, so it’s important to understand which options best fit your situation.

Who Is Eligible for Federal Student Loans?

To qualify for federal student loans for college, you must meet certain eligibility criteria:

-

Citizenship status: You must be a U.S. citizen or eligible non-citizen (such as a permanent resident).

-

Enrollment: You must be enrolled at least half-time in a degree or certificate program at an accredited school.

-

Valid Social Security Number: Required in most cases.

-

Satisfactory academic progress: You must maintain a minimum GPA and complete a certain percentage of attempted courses.

-

FAFSA submission: You must complete the Free Application for Federal Student Aid (FAFSA) each year to be considered.

Some loans, like Direct Subsidized Loans, are only available to students who demonstrate financial need, while others, like Direct Unsubsidized Loans, do not require financial need.

How to Apply for Federal Student Loans

Applying for federal student loans for college is a straightforward process, but timing and accuracy are crucial. Here’s how to get started:

-

Complete the FAFSA

The Free Application for Federal Student Aid (FAFSA) is the first and most important step. Submit it online at studentaid.gov as early as possible after it opens (typically October 1st each year). -

Review Your Student Aid Report (SAR)

After submitting the FAFSA, you’ll receive a summary of your information. Make sure everything is correct and update if needed. -

Check with Your School’s Financial Aid Office

Your school will use your FAFSA data to determine your eligibility for federal student loans and other aid. They’ll send you a financial aid award letter outlining your loan options. -

Accept Your Loans

You can choose to accept all, some, or none of the loans offered. Log in to your student aid account to confirm. -

Complete Entrance Counseling & Master Promissory Note (MPN)

First-time borrowers must complete entrance counseling and sign the MPN, which is your official loan agreement.

Apply early to maximize your chances of receiving aid and avoid delays in tuition payments.

Interest Rates and Fees

One of the biggest advantages of federal student loans for college is their fixed, relatively low interest rates compared to private lenders. These rates are set annually by the U.S. Department of Education and vary by loan type and borrower status:

-

Direct Subsidized & Unsubsidized Loans (Undergraduate): Fixed rate (e.g., around 5.5% for the 2024–2025 academic year*)

-

Direct Unsubsidized Loans (Graduate/Professional): Slightly higher fixed rate

-

Direct PLUS Loans: Highest fixed rate among federal loans

In addition to interest, there is an origination fee—a percentage of the loan amount deducted before funds are disbursed. This fee usually ranges between 1% and 4%.

Understanding the cost of borrowing is essential for long-term financial planning. Federal loans may also offer interest subsidies (for subsidized loans), which help reduce the overall repayment burden.

Pros and Cons of Federal Student Loans

Before taking on debt, it’s important to weigh the pros and cons of federal student loans for college:

Pros:

-

Lower, fixed interest rates compared to most private loans

-

No credit check required (except for PLUS loans)

-

Income-driven repayment and forgiveness programs

-

Deferment and forbearance options during financial hardship

-

Subsidized interest for qualifying students

Cons:

-

Borrowing limits may not cover the full cost of college

-

Origination fees reduce the amount you actually receive

-

Loan debt can accumulate quickly, especially with unsubsidized loans

-

Interest accrues during school for unsubsidized and PLUS loans

Understanding both the advantages and limitations helps you make smarter borrowing decisions and avoid unnecessary debt.

Tips for Managing Your Student Loans

Successfully handling federal student loans for college starts with smart borrowing and responsible management. Here are some practical tips:

-

Borrow only what you need: Don’t automatically accept the full loan amount offered. Calculate your real educational expenses and borrow accordingly.

-

Keep track of your loans: Use the Federal Student Aid dashboard to view balances, interest, and loan servicer information.

-

Make interest payments while in school: If you can, pay off interest on unsubsidized loans to reduce your total repayment amount later.

-

Set up autopay: Many loan servicers offer a small interest rate discount when you enroll in automatic payments.

-

Explore forgiveness and assistance programs: Check if you qualify for Public Service Loan Forgiveness, Teacher Loan Forgiveness, or state-specific programs.

-

Use budgeting tools: Monitor your spending and build a repayment plan even before graduation to stay financially prepared.

Managing your loans wisely can prevent future stress and put you on a path to financial independence after college.

Conclusion

Federal student loans for college are a vital resource for students who need financial help to pursue higher education. With low fixed interest rates, flexible repayment plans, and borrower protections, they offer significant advantages over private loans.

By understanding your options, applying early, and managing your loans carefully, you can make the most of what federal aid has to offer — and graduate with greater peace of mind.

If you’re getting ready for college, take time to explore all federal student loan programs and plan your finances thoughtfully. Your future self will thank you.