While federal loans are often the best option for most students due to their lower interest rates and flexible repayment terms, private loans can sometimes be necessary. Understanding the differences between federal loans and private loans will help you make the best decision for your financial situation.

Interest Rates: Federal Loans vs. Private Loans

One of the most significant differences between federal loans and private loans is the interest rate. Federal loans generally offer lower and fixed interest rates, while private loans may have variable rates, which can change over time.

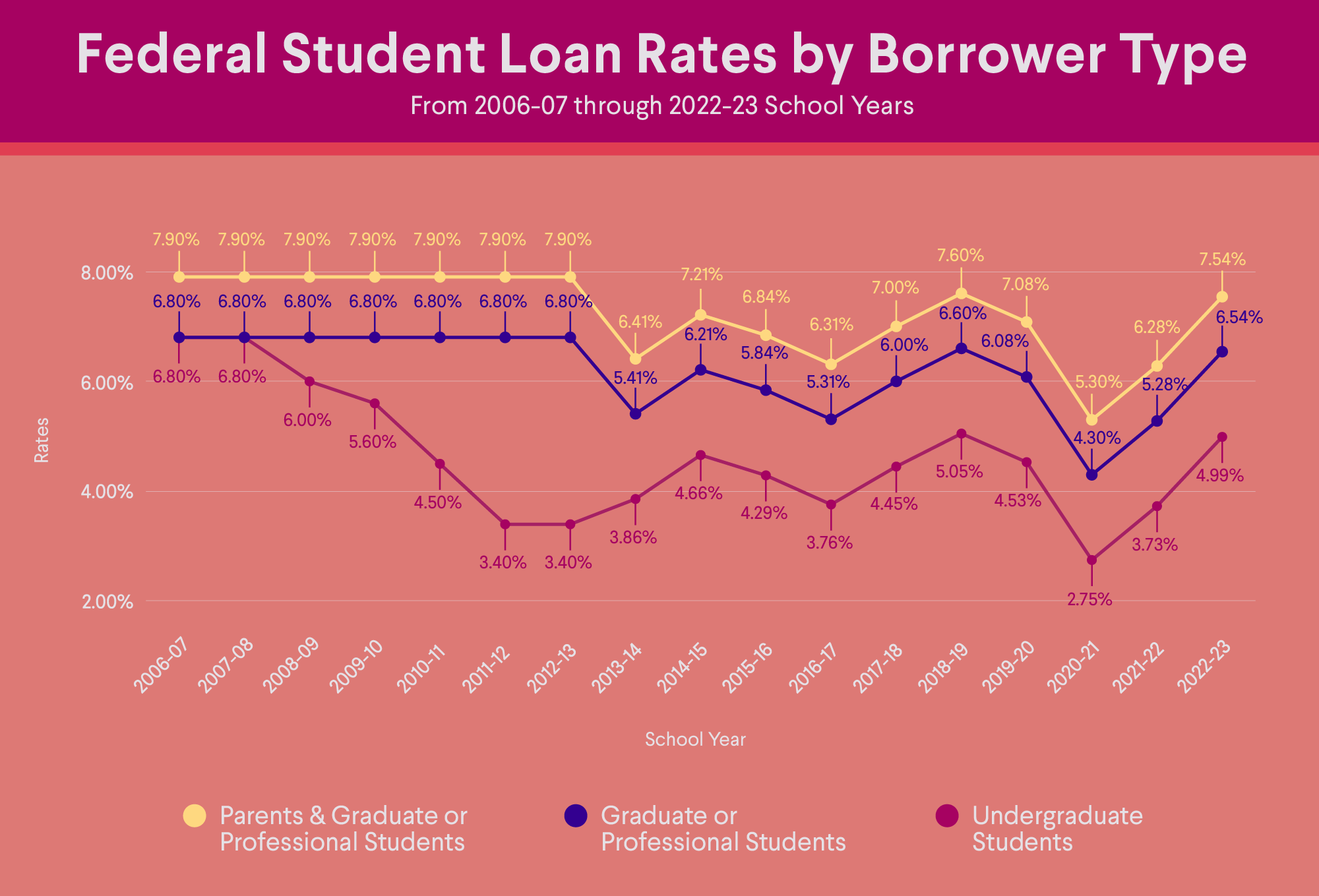

Federal Loan Interest Rates

The interest rates for federal loans are fixed and regulated by the government. As of the 2024-2025 school year, here are the interest rates for different types of federal loans:

- Direct Subsidized and Unsubsidized Loans: 6.53% for undergraduate students.

- Direct Unsubsidized Loans for Graduate Students: 8.08%.

- PLUS Loans (for parents and graduate students): 9.08%.

These rates remain constant over the life of the loan, providing predictability and stability for borrowers.

Private Loan Interest Rates

Private loan interest rates can vary depending on the lender, your creditworthiness, and the type of loan. Here are some general ranges for private student loans:

- Variable APR: 5.04% to 15.21% (with autopay).

- Fixed APR: 3.49% to 15.49%.

While private loans can sometimes offer competitive rates, they are often higher than federal loans, and the rates can increase if you have a variable APR. Additionally, private loans may not offer the same repayment flexibility or borrower protections as federal loans.

Repayment Terms and Options

Another crucial factor to consider when comparing federal loans and private loans is the repayment terms.

Federal Loan Repayment Plans

Federal loans offer several repayment plans that can be adjusted based on your financial situation, including:

- Standard Repayment Plan: Fixed monthly payments over 10 years.

- Graduated Repayment Plan: Payments start lower and gradually increase every two years, typically over 10 years.

- Income-Driven Repayment Plans: Payments are based on your income and family size, with potential for loan forgiveness after 20 or 25 years of qualifying payments.

These flexible repayment options can significantly ease the burden of loan repayment after graduation.

Private Loan Repayment Plans

Private lenders may offer some repayment flexibility, but they generally do not provide the same range of options as federal loans. The repayment terms for private loans are typically less flexible, and many lenders do not offer income-based repayment or loan forgiveness options.

Loan Forgiveness: A Key Federal Benefit

One of the most significant benefits of federal loans is the potential for loan forgiveness. Certain federal loans, such as Direct Subsidized Loans and Direct Unsubsidized Loans, may be eligible for Public Service Loan Forgiveness (PSLF) after 10 years of qualifying payments in a public service job. This can be a huge advantage for students planning to work in the public sector.

Private loans, on the other hand, do not offer forgiveness programs. This means you will need to repay the loan in full, including any interest that has accrued, unless you refinance.

Eligibility and Requirements

Federal Loan Eligibility

To qualify for federal student loans, you must submit the Free Application for Federal Student Aid (FAFSA). The government will use your FAFSA information to determine your eligibility for federal loans based on your financial need, enrollment status, and other factors. Federal loans are available to both undergraduate and graduate students.

Private Loan Eligibility

Private loans are credit-based, which means your credit score and financial history play a significant role in determining your eligibility and the interest rates offered. If you have limited credit history or a low credit score, you may need a cosigner to qualify.

When to Consider Private Loans

While federal loans should be your first option, there are times when private loans might be necessary. If you’ve exhausted all federal loan options and still need additional funds, private loans can be a viable alternative. However, before committing to a private loan, consider the following:

- Compare interest rates from multiple lenders.

- Understand the repayment terms and make sure they work for you.

- Check for any borrower protections offered by the private lender.

How to Apply for Student Loans

The process of applying for both federal and private student loans differs, and it’s important to understand the steps involved in each.

Step 1: Apply for Federal Loans

To apply for federal student loans, you must complete the Free Application for Federal Student Aid (FAFSA). The FAFSA will ask for information about your financial situation, which will help determine your eligibility for federal loans, grants, and work-study programs.

Once you’ve submitted your FAFSA, your school’s financial aid office will send you a Financial Aid Award Letter, which outlines the types and amounts of aid you’re eligible to receive, including federal student loans.

Step 2: Apply for Private Loans (If Needed)

If you need additional funding beyond what federal loans provide, you can apply for private student loans directly through the lender. Most lenders will require a credit check to determine your interest rate and eligibility. If you have limited credit or a low credit score, you may need a cosigner.

Compare rates and terms from various lenders to find the best loan option for your needs. Once approved, you’ll sign a loan agreement and receive the funds directly from the lender.

Tips for Managing Student Loan Debt

Managing student loan debt can be overwhelming, but with the right strategies, you can pay off your loans efficiently and avoid financial stress. Here are some tips to help you stay on track:

1. Start Making Payments While in School

Even if you’re not required to make payments while in school, consider paying the interest on your loans. This will prevent the interest from accumulating and increasing your loan balance.

2. Explore Income-Driven Repayment Plans

If you’re struggling to make payments after graduation, income-driven repayment plans can help by adjusting your monthly payments based on your income. If you have federal loans, look into plans like Income-Based Repayment (IBR) or Pay As You Earn (PAYE).

3. Look for Loan Forgiveness Programs

If you plan to work in public service, explore Public Service Loan Forgiveness (PSLF) programs. This program forgives your remaining federal student loan balance after 10 years of qualifying payments.

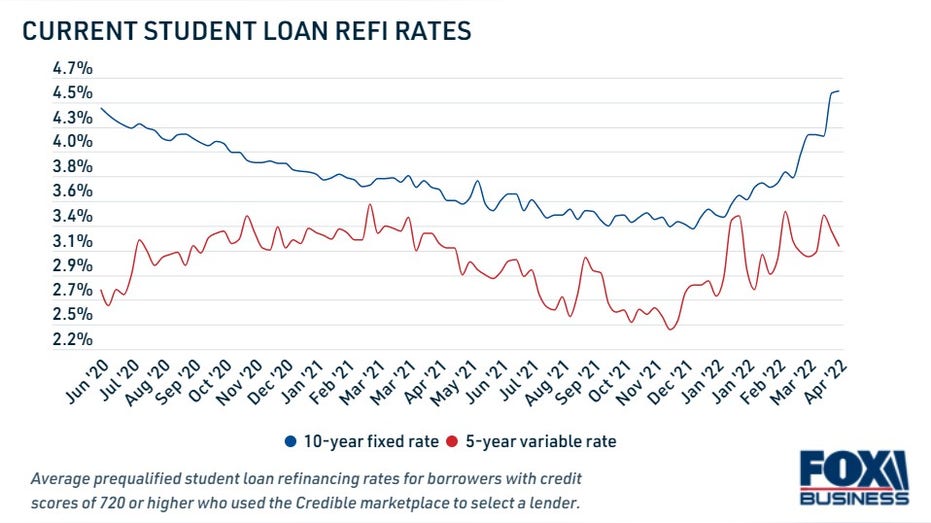

4. Consider Refinancing Your Loans

If your financial situation improves and interest rates drop, consider refinancing your private loans or federal loans to lower your interest rates. Keep in mind that refinancing federal loans will cause you to lose access to borrower protections, such as income-driven repayment and loan forgiveness options.

FAQs About Low-Interest Loans for College Students

1. What are the best low-interest loans for college students in the U.S.?

- Federal student loans are generally the best option due to their lower fixed interest rates, flexible repayment options, and loan forgiveness programs. Private loans may be necessary if you’ve exhausted all federal loan options.

2. How do I qualify for federal student loans?

- To qualify for federal student loans, you need to complete the FAFSA. Your eligibility will be based on your financial need, enrollment status, and other factors.

3. Are private loans better than federal loans?

- Private loans often come with higher interest rates and fewer repayment options than federal loans, making them a less favorable choice. However, they may be a necessary option if you need additional funding after federal loans.

4. Can private loans be refinanced?

- Yes, private loans can be refinanced, which may result in a lower interest rate. However, refinancing federal loans may cause you to lose access to borrower protections such as income-driven repayment and loan forgiveness.

Conclusion

Choosing the right low-interest loans for your education is a crucial step toward ensuring financial stability after graduation. Federal loans are the best option for most students due to their competitive interest rates, flexible repayment options, and loan forgiveness programs. Private loans can serve as a secondary option but should be carefully considered due to their higher interest rates and less favorable terms.

By understanding the differences between federal and private loans, and following the tips provided, you can make an informed decision that will set you up for success in both your education and financial future.

For more information on federal student loans, visit the Federal Student Aid website.