For those students who are willing to take on more risk in exchange for the potential of higher returns, higher-risk investment options may be appealing. While these options can offer greater rewards, they also come with the risk of losing your invested money, so it’s important to weigh the potential risks carefully.

Commission-Free Investing

Commission-free investing has become more popular in recent years, especially with the rise of platforms like Robinhood, Webull, and Merrill Edge. These platforms allow users to trade stocks, ETFs, and even options without paying commissions on each trade.

- Benefits:

- Low-cost access to a wide range of investments.

- No trading fees make it easier for small investors to participate in the stock market without worrying about high costs.

- Access to a variety of stocks and ETFs, allowing you to diversify your investments.

- Drawbacks:

- Market risk: While commission-free, these investments still carry the usual risks of the stock market, including the possibility of losing your principal.

- Fees may apply for more advanced services or features such as options trading, margin accounts, or premium services.

For students looking to start investing with small amounts, commission-free platforms provide an affordable entry point into the world of stock and ETF investing.

Fractional Stocks

One option to help students who may not have the funds to buy full shares of expensive stocks is fractional stocks. Platforms like Fidelity, Robinhood, and Stash allow you to buy fractions of expensive stocks, meaning you can invest in high-value companies like Amazon, Tesla, or Apple, without needing to purchase an entire share.

- Benefits:

- Lower cost of entry: Fractional shares allow you to invest in top companies for as little as a few dollars.

- Diversification: With fractional shares, you can spread your investment across multiple stocks or sectors without needing large sums of money.

- Increased accessibility: Even if you don’t have enough money for an entire share, fractional stocks make investing more inclusive.

- Drawbacks:

- Potential for lower returns: While fractional shares offer the same growth potential as full shares, the amount of profit you make is based on the amount you invest, which may limit returns compared to a full share investment.

- Not available on all platforms: Not all stock platforms offer fractional shares, so you may need to find one that supports this option.

Investing in fractional stocks can be an excellent way for students to participate in the stock market without needing significant capital. However, it’s important to understand that the smaller the investment, the smaller the returns.

Important Considerations Before Investing Student Loan Money

Before making any investment decisions, students must carefully evaluate their current financial situation and the long-term implications of using student loan funds for investing. Here are some important factors to consider:

Legal Implications

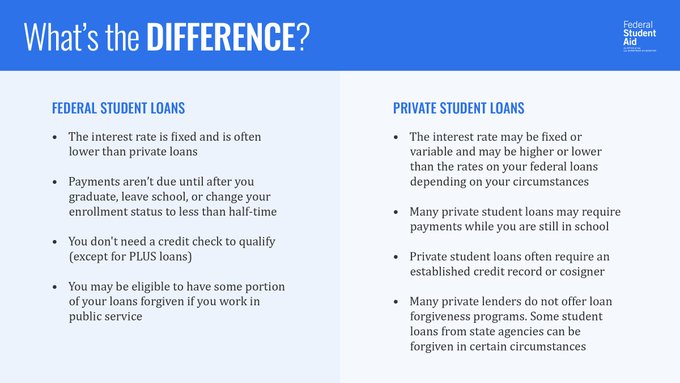

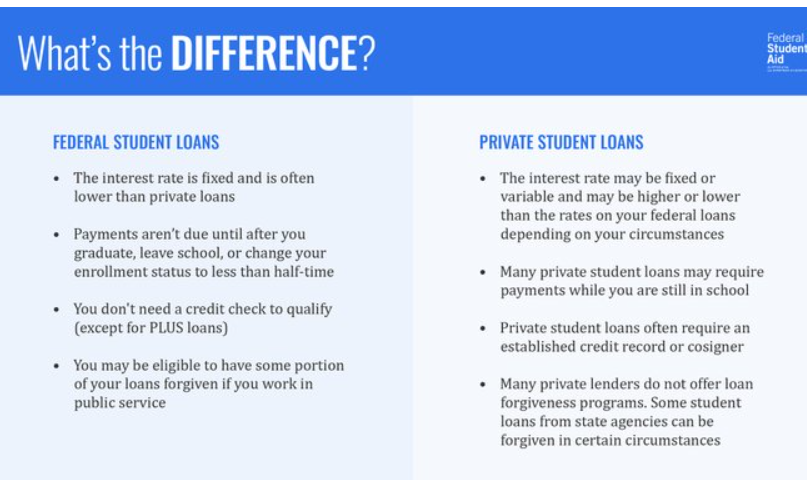

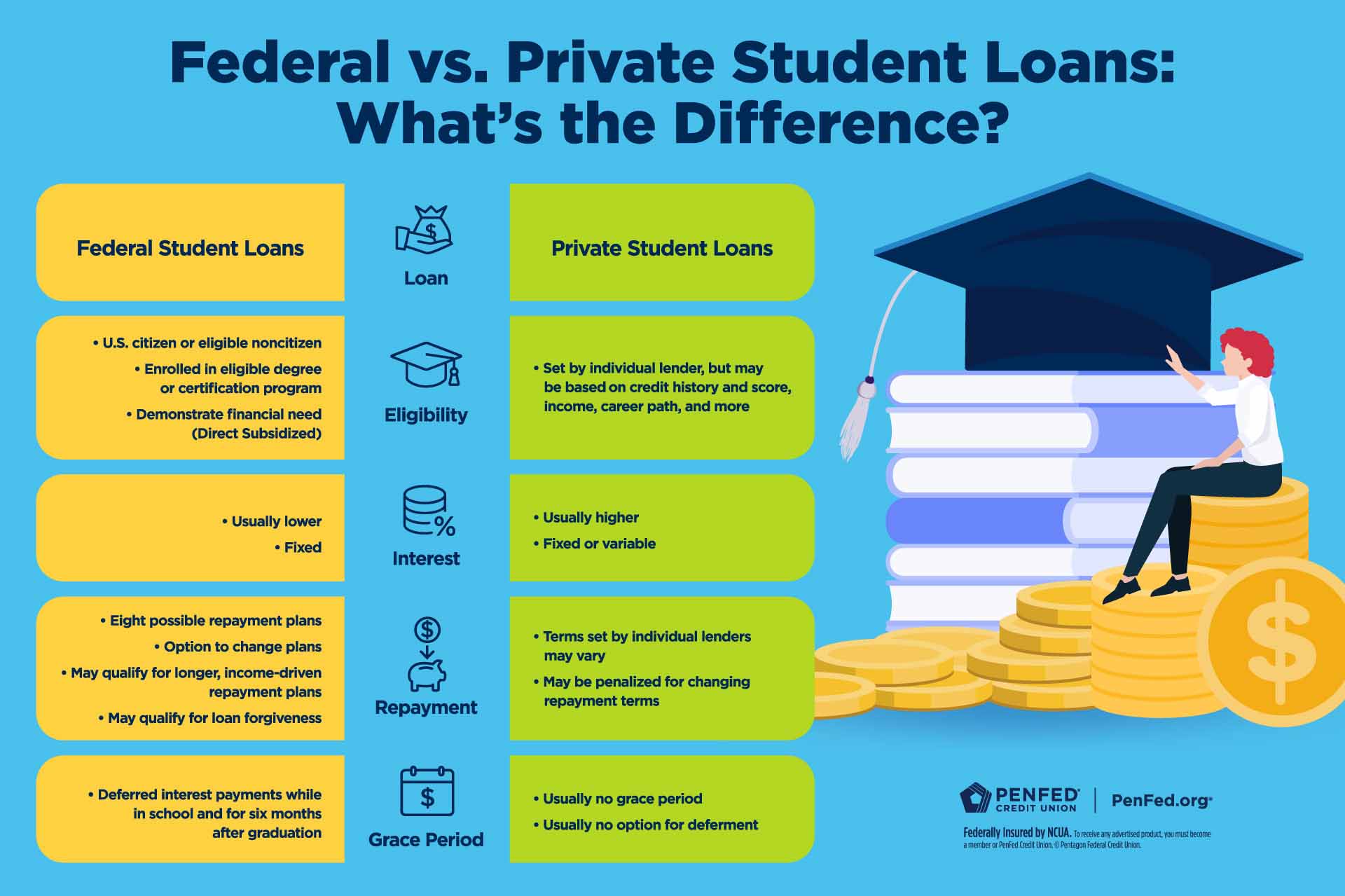

As mentioned, government-subsidized loans typically have strict guidelines on how the funds can be used. If you misuse these funds, you could face serious financial consequences or risk losing eligibility for future funding. Private loans offer more flexibility, but even then, investing borrowed money should be approached with caution. Always make sure you are not violating the terms of your loan by using the funds for investments instead of educational expenses.

Risk vs. Return

The most crucial factor to consider when deciding to invest student loan funds is your risk tolerance. Investments inherently come with the potential for loss. While some options like high-yield savings accounts and GICs offer relatively low risk, higher-return options like stocks, ETFs, or fractional shares come with a much higher risk.

It’s vital to assess whether you’re willing to risk losing borrowed money and whether the return on investment (ROI) is worth the risk of losing money that might need to be used for your education or living expenses.

Repayment Timeline

Consider your loan repayment timeline when making investment decisions. For example, if you’re planning to graduate soon and will need to repay your loans shortly after, short-term investments like high-yield savings accounts or GICs may be more appropriate. These options offer predictable returns with minimal risk, which is essential if you need to preserve your capital for loan repayment.

If you are a few years away from graduation and have a longer timeline, you might consider taking on more risk in the form of index funds or ETFs, which have the potential for greater long-term returns.

Alternative Options

If you’re uncertain about investing your student loan money, it might be worth considering alternatives such as refinancing your loans. Refinancing can lower your interest rate, which can save you money over time. By lowering your monthly payments, you might have more flexibility with your finances and fewer risks involved than if you were to invest loan funds.

For students who are interested in long-term wealth building, refinancing may free up money that could be better spent on investments outside of the initial student loan funds. Refinancing options should be explored with your loan servicer or financial advisor to determine if it’s the right choice for your situation.

FAQs: Investment Opportunities with Student Loan Funds

1. Can I invest my student loan money?

- Yes, you can technically invest student loan funds, but there are restrictions, especially if your loan is federally subsidized. Federal loans are primarily intended for educational expenses, so using the money for investments could be a violation of your loan terms.

2. What are the safest ways to invest student loan funds?

- The safest options include high-yield savings accounts and GICs. These investments offer low risk, making them ideal for students who want to avoid losing money while earning some return on their funds.

3. What are the risks of investing student loan money?

- The main risk is that you could lose the money you’ve borrowed if the investment performs poorly. Additionally, you could face legal issues if you misuse federal loan funds by investing them instead of using them for educational expenses.

4. Is it better to invest student loan money or pay down the loan?

- It’s typically recommended to pay down your loan before investing, especially if the loan interest rate is high. However, for students with longer repayment timelines, investing in safer options like index funds may provide a good long-term strategy.

Conclusion

While investing student loan money can seem appealing, it’s important to approach this decision with caution. For most students, the primary purpose of student loans is to fund education. Low-risk investments like high-yield savings accounts or GICs are safer options if you want to grow your funds. If you’re willing to take on more risk, moderate-risk options like index funds and ETFs, or higher-risk investments like fractional stocks can offer the potential for higher returns, but they come with more volatility.

Before deciding to invest, always evaluate your financial situation, consider loan repayment timelines, and consult a financial advisor to ensure you’re making the right decision for your future.

For more detailed guidance on student loans and managing them effectively, visit Federal Student Aid.