Introduction

Navigating the world of low-interest loans for college students in America is essential when financing your education. With tuition costs continuing to rise, students need to understand their options to secure the best possible financial aid. Federal loans are often the first choice due to their competitive interest rates and flexible repayment terms. However, private student loans can sometimes be a necessary solution to cover remaining costs after exhausting federal loan options.

In this article, we’ll break down the different low-interest loans available to college students, focusing on both federal student loans and private loans. We will also explore the benefits, drawbacks, and eligibility requirements for each, so you can make an informed decision about how to fund your education.

Why Low-Interest Loans Matter

The interest rate on your student loans can have a significant impact on the total amount you will owe over the life of the loan. For example, a higher interest rate means more money will go toward paying interest rather than the principal balance, increasing the overall cost of the loan.

Low-interest loans help minimize the financial burden on students, allowing them to pay off their debts more efficiently. Here’s why choosing loans with lower interest rates is essential:

- Lower Monthly Payments: With a lower interest rate, your monthly payments will be smaller, making it easier to manage your finances while in school and after graduation.

- Less Interest Accumulation: Lower rates mean less money will accumulate over time, saving you a substantial amount of money in the long run.

- Faster Loan Repayment: Paying less interest allows you to pay off your principal balance faster, reducing the total debt burden after graduation.

As you explore your financing options, keeping interest rates in mind is crucial. Federal student loans are typically the best place to start, but we’ll also dive into private loan options that may be necessary if you need additional funding.

Federal Student Loans: The Best Option for Most Students

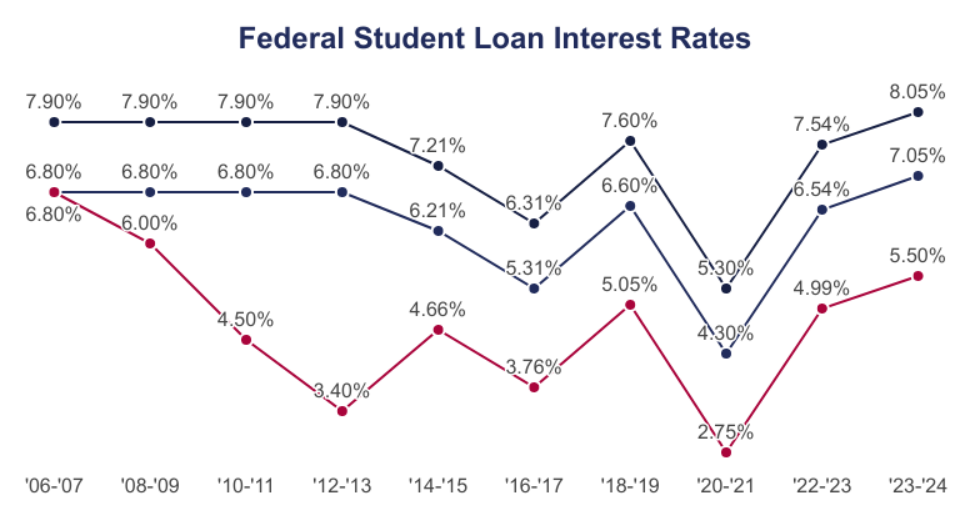

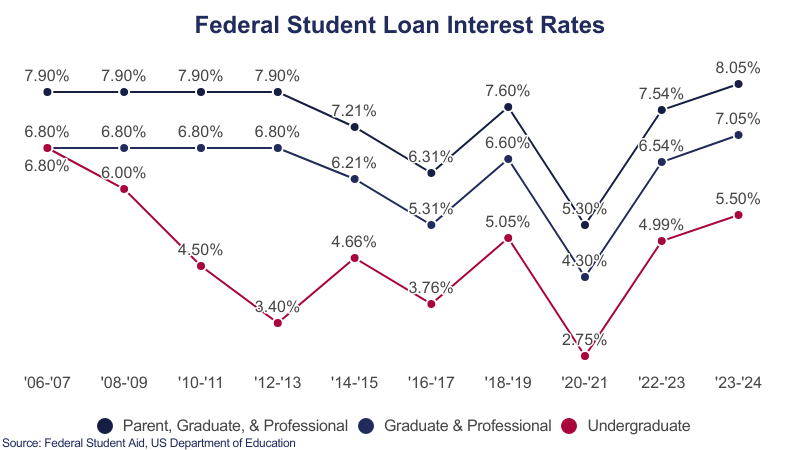

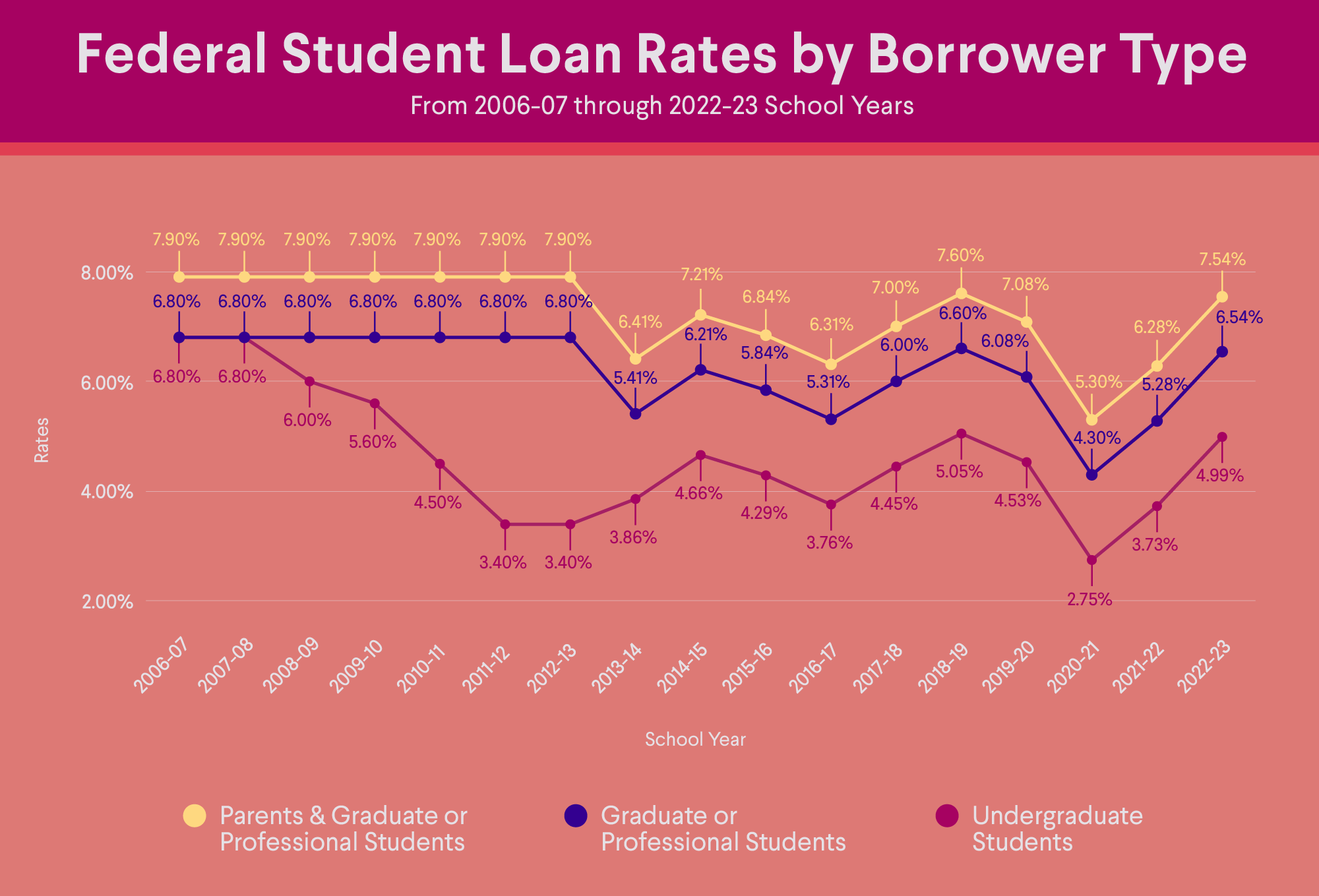

For many students, federal student loans are the most affordable and flexible option available. These loans come with fixed interest rates, a variety of repayment plans, and potential loan forgiveness programs, making them the preferred choice for most college students.

Types of Federal Student Loans

The U.S. government offers several types of federal student loans, each with its own features. Let’s take a closer look at each one:

Direct Subsidized Loans

Direct Subsidized Loans are available to undergraduate students who demonstrate financial need. These loans offer an interest rate of 6.53% for the 2024-2025 school year. One of the most significant advantages of subsidized loans is that the government pays the interest while you’re in school, during the grace period, and while you’re in deferment. This means that your loan balance won’t grow while you’re still pursuing your degree.

These loans are ideal for students who have financial need and want to avoid accumulating interest while in school.

Direct Unsubsidized Loans

Direct Unsubsidized Loans are available to all students, regardless of financial need. The interest rate for undergraduates is 6.53%, and for graduate students, it’s 8.08% for the 2024-2025 school year. Unlike subsidized loans, the interest on unsubsidized loans begins to accrue as soon as the loan is disbursed. While this means you’ll end up paying more in the long term, it still offers a relatively low interest rate compared to private loans.

These loans are a good option for students who don’t qualify for subsidized loans but still want access to federal funding with reasonable rates.

PLUS Loans

PLUS Loans are available to parents of dependent undergraduate students and graduate students themselves. These loans are intended to help cover the cost of attendance beyond what other federal loans provide. The interest rate for PLUS Loans is 9.08% for the 2024-2025 school year.

Although the interest rate for PLUS Loans is higher than that of other federal loans, they offer flexible repayment options and the ability to borrow a higher amount based on the cost of attendance.

Advantages of Federal Loans

Federal loans come with several benefits that make them the top choice for many students:

- Low Fixed Interest Rates: Federal loans generally offer lower interest rates compared to private loans, and the rates are fixed, meaning they won’t change throughout the life of the loan.

- Income-Based Repayment Plans: If you’re having trouble making payments, federal loans offer repayment plans based on your income, which can reduce monthly payments and extend the repayment term.

- Loan Forgiveness Programs: Certain federal loans, such as Public Service Loan Forgiveness (PSLF), can forgive your loan balance after a set number of qualifying payments in public service jobs.

- Deferment and Forbearance Options: Federal loans provide options to temporarily pause payments if you face financial hardship or need to return to school.

Overall, federal student loans are designed with students in mind, offering numerous benefits that make them a better choice than private loans for most borrowers.

Private Student Loans: A Secondary Option

While federal loans should always be the first choice for most students, there are times when private loans become necessary. If federal loans don’t cover the full cost of your education, you may need to turn to private lenders for additional funding.

Key Features of Private Loans

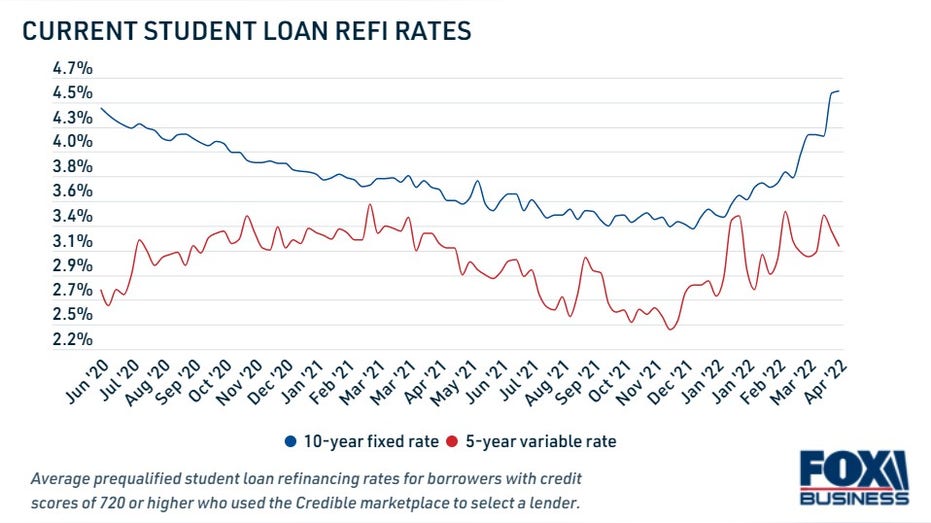

Private loans are offered by banks, credit unions, and other financial institutions. They typically have higher interest rates than federal loans, and the rates are usually variable, meaning they can change over time. While private loans can be a helpful source of funding, there are several important factors to consider:

- Stricter Eligibility Requirements: Private loans are credit-based, meaning your credit score and financial history will play a large role in determining your eligibility and interest rates. If you don’t have a strong credit history, you may need a cosigner to qualify.

- Higher Interest Rates: Private loans often come with higher interest rates compared to federal loans. The rates for private student loans can range from as low as 3.49% with autopay to 15% for those with lower credit scores.

- Limited Repayment Options: Unlike federal loans, private loans may not offer income-driven repayment options or loan forgiveness programs.

Despite these drawbacks, private loans may be a good choice if you need extra funds and are in a position to qualify for favorable terms.

Top Private Student Loan Lenders

Several private lenders offer competitive rates on student loans. Some of the top options include:

- Sallie Mae: Known for its flexible loan terms, Sallie Mae offers variable APRs ranging from 5.04% to 15.21% and fixed APRs from 3.49% to 15.49% with autopay.

- College Ave: Offers a fixed APR ranging from 3.69% to 15.28%, providing flexibility in terms of repayment schedules.

- ELFI: Provides variable APRs from 5.00% to 14.22% and fixed APRs ranging from 3.69% to 14.22%.

If you’re considering a private loan, it’s important to compare the rates, terms, and repayment options offered by different lenders to ensure you’re getting the best deal possible.

The next part of this article will delve deeper into comparing federal loans and private loans, as well as guide you through the process of applying for both types of loans. Stay tuned to learn how to make the best financial decisions for your education and future.