Paying for college has become increasingly expensive, with tuition, housing, books, and other living costs rising year after year. While many students rely on federal financial aid, federal loans and grants often fall short of covering the full cost of attendance—especially at private universities or out-of-state schools.

When federal aid isn’t enough, students and their families often turn to private college loan options to bridge the gap. These loans, offered by banks, credit unions, and online lenders, can provide the extra funds needed to stay in school and focus on academic success.

Unlike federal loans, private loans are based on creditworthiness and may offer a variety of terms, interest rates, and repayment options. Choosing the right private loan requires careful comparison and understanding of how each option fits your financial goals.

In this guide, we’ll walk you through everything you need to know about private college loans—including types of loans, top lenders, how to apply, and tips to borrow wisely. Whether you’re an undergraduate, graduate, or a parent helping to fund education, this resource will help you make informed decisions.

What Are Private College Loans?

Private college loans, also known as private student loans, are loans provided by private financial institutions to help students and their families pay for higher education. These loans can cover tuition, fees, books, housing, and other college-related expenses.

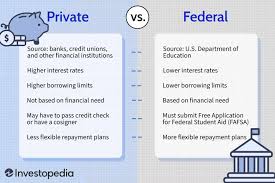

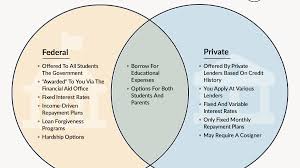

How They Differ from Federal Student Loans

Unlike federal student loans, which are funded and regulated by the U.S. Department of Education, private student loans are issued by private lenders such as:

-

Banks (e.g., Citizens Bank, Wells Fargo)

-

Credit unions

-

Online lenders (e.g., Sallie Mae, SoFi, College Ave)

Key differences include:

-

Credit-based approval: Private loans typically require a credit check and may need a cosigner for approval, especially for students with limited credit history.

-

Interest rates: These can be fixed or variable and are usually based on your creditworthiness.

-

Repayment terms: Private lenders offer various repayment options but generally less flexibility than federal programs.

-

No federal protections: Private loans do not offer income-driven repayment plans, loan forgiveness programs, or guaranteed deferment options.

When Are Private Loans Typically Used?

Private college loans are most commonly used after all federal aid options have been exhausted. This includes federal loans, Pell Grants, scholarships, and work-study programs.

Students often turn to private loans when:

-

Their federal loan limits are maxed out

-

They attend a school or program not eligible for federal aid

-

They need funding quickly and have strong credit or a creditworthy cosigner

Private loans can be a valuable financial resource—but should be approached with caution and careful comparison.

Who Should Consider Private College Loans?

While federal student loans should always be considered first due to their borrower protections and flexible repayment terms, private college loans can be a smart solution for certain students and families—especially when federal aid isn’t enough.

Here are the most common situations where private student loans are worth considering:

1. Students Who Have Exhausted Federal Financial Aid

Federal loans come with borrowing limits:

-

Undergraduate students can borrow up to $5,500–$12,500 per year.

-

Graduate students can borrow up to $20,500 in Direct Unsubsidized Loans.

If your cost of attendance (COA) exceeds these limits, a private loan can help cover the remaining gap.

2. Students Attending Non-Eligible Institutions or Programs

Not all schools or programs qualify for federal aid—especially non-degree, certificate, online-only, or international institutions. In these cases, private lenders may still offer loans to eligible students.

3. Borrowers With Strong Credit or a Creditworthy Cosigner

Private student loans are based on creditworthiness. Students with excellent credit—or those applying with a qualified cosigner such as a parent—can often secure:

-

Lower interest rates

-

Higher loan amounts

-

More favorable repayment terms

4. Graduate and Professional Students Needing Additional Funding

Students in medical, law, business, or graduate programs often face higher educational expenses. Even with access to federal Grad PLUS loans, some may seek private loans for:

-

Lower rates (if credit is strong)

-

Customized repayment options

-

Additional funds not covered by federal loans

5. Parents Looking to Help Finance Education

Parents who don’t want to take out federal Parent PLUS loans (due to their high interest rates or origination fees) may consider private parent student loans as an alternative—especially if they have strong credit.

Types of Private College Loan Options

Private lenders offer a variety of student loan products tailored to different academic levels, borrower profiles, and school types. Understanding these options can help you choose the loan that best fits your needs.

a. Undergraduate Private Student Loans

These loans are designed for students pursuing associate or bachelor’s degrees. Since many undergraduates have limited or no credit history, most lenders require a cosigner, such as a parent or guardian.

Key features:

-

Can cover up to the full cost of attendance

-

Often come with flexible repayment options (deferred, interest-only, or immediate)

-

May offer in-school deferment and grace periods after graduation

b. Graduate and Professional School Loans

Private loans for graduate students are tailored to higher educational costs in programs like:

-

Law

-

Medicine

-

Business (MBA)

-

Master’s and doctoral degrees

Benefits include:

-

Higher loan limits to match graduate tuition

-

Repayment options that align with expected post-graduation income

-

Some lenders offer dedicated medical/dental school loans with extended deferment during residency

c. Parent Loans from Private Lenders

Private parent student loans allow parents (or legal guardians) to borrow on behalf of their child. These are similar in concept to federal Parent PLUS loans but can offer:

-

Lower interest rates (if the parent has strong credit)

-

Fewer fees

-

Flexible repayment plans

Note: These loans remain the parent’s responsibility—not the student’s.

d. Career Training and Trade School Loans

Students pursuing non-traditional education such as:

-

Vocational training

-

Technical programs

-

Coding bootcamps

-

Certification courses

…may find that federal aid doesn’t apply. Fortunately, some private lenders specialize in loans for career and alternative education programs.

Look for lenders that partner directly with trade schools or offer Income Share Agreements (ISAs) as alternatives.

Key Features to Compare Across Lenders

Choosing the right private college loan means more than just picking the first lender you find. Every lender offers different terms, rates, and borrower benefits. To make the best decision, carefully compare these key features:

1. Interest Rates (Fixed vs. Variable)

-

Fixed interest rates stay the same for the life of the loan, offering predictable monthly payments.

-

Variable interest rates may start lower but can change over time, depending on market conditions—potentially increasing your total cost.

✅ Tip: If you prefer stability, fixed rates are usually the safer choice. If you plan to repay quickly, a low initial variable rate might save money.

2. Repayment Options

Most lenders offer several repayment plans:

-

Immediate repayment: Start making full payments right away (lowest total cost)

-

Interest-only repayment: Pay just the interest while in school

-

Deferred repayment: No payments while in school (interest accrues)

Some lenders also offer grace periods after graduation. Be sure to understand when payments begin.

3. Loan Fees

Check for:

-

Origination fees (some lenders charge a percentage of the loan upfront)

-

Late payment penalties

-

Prepayment penalties (rare, but worth checking)

Low or zero fees can significantly reduce your total loan cost.

4. Loan Terms (Repayment Length)

Most private loans offer terms ranging from 5 to 20 years.

Shorter terms = higher monthly payments but lower total interest.

Longer terms = lower payments but more interest over time.

Choose a loan term that balances affordability and cost-efficiency.

5. Cosigner Release Policy

If you need a cosigner, check if the lender offers cosigner release—typically after 1–3 years of on-time payments and a credit review.

✅ A good cosigner release option allows you to remove the cosigner once you’ve established your own credit.

6. Forbearance or Deferment Options

Some private lenders offer limited forbearance or hardship programs if you lose a job or face financial trouble.

⚠️ Note: These are usually less generous than federal forbearance options, so read the fine print carefully.

7. Borrower Benefits and Discounts

Look for perks like:

-

Autopay discounts (typically 0.25% off your interest rate)

-

Loyalty discounts if you have other accounts with the lender

-

Career coaching, scholarship tools, or financial literacy resources

Top Private Student Loan Lenders (2024–2025)

When searching for the best private college loan, choosing a trusted lender with competitive rates and borrower-friendly features is key. Below is a list of top-rated private student loan lenders for 2024–2025, based on reputation, flexibility, and customer reviews.

1. Sallie Mae

-

Wide range of loan products: undergraduate, graduate, career training

-

No origination fees or prepayment penalties

-

Multiple repayment plans and in-school deferment options

-

Cosigner release available after 12 on-time payments

2. College Ave

-

Known for customizable loan terms (5–15 years)

-

Offers student loans, parent loans, and refinance options

-

Competitive fixed and variable rates

-

Cosigner release after 24 on-time payments

-

Prequalification with a soft credit check

3. SoFi

-

Ideal for graduate students and refinancing

-

No fees, career support, and unemployment protection

-

Loans up to 100% of the school-certified cost of attendance

-

Extra benefits: networking events and financial planning tools

4. Discover Student Loans

-

No fees at all (including no late or origination fees)

-

1% cash reward for good grades

-

Fixed and variable rate options

-

Deferment, forbearance, and in-school options included

5. Earnest

-

Flexible repayment options and skip-a-payment feature

-

Cosigner not required for eligible students

-

Soft credit check for rate preview

-

Offers 9-month grace period after graduation (longer than most)

6. Ascent

-

Offers non-cosigned loans for eligible students

-

Tailored for undergrads, grads, and career training

-

Cash-back graduation rewards

-

Cosigner release in as little as 12 months

7. Citizens Bank

-

Student loans and refinancing available

-

Loyalty discount for existing customers

-

Multi-year approval feature (reapply once for multiple years)

-

Parent loans also offered

8. Credible (Marketplace Aggregator)

-

Compare up to 10 lenders at once with one form

-

Doesn’t issue loans directly—connects you with lenders

-

Soft credit check to prequalify

-

Time-saving tool if you’re comparing rates

✅ Tips for Choosing a Lender

-

Always compare interest rates, fees, and repayment terms

-

Use prequalification tools to preview your rate without a hard credit pull

-

Read customer reviews and check for hidden fees or poor service

Eligibility Requirements for Private College Loans

Before applying for a private college loan, it’s important to understand what lenders typically require. Unlike federal student loans, private loans are credit-based, meaning your eligibility depends heavily on your financial profile—or that of your cosigner.

Here are the most common eligibility requirements for private student loans:

1. U.S. Citizenship or Permanent Residency

Most lenders require the borrower (or cosigner) to be:

-

A U.S. citizen, or

-

A permanent resident (green card holder)

Some lenders also offer loans for international students, but only with a qualified U.S.-based cosigner.

2. Enrollment in an Eligible School or Program

To qualify, you must:

-

Be enrolled at least half-time in a degree-granting program at an eligible institution

-

Provide school enrollment verification

Some lenders also cover:

-

Non-degree, certificate, or trade school programs

-

Online-only institutions (case by case)

3. Good Credit History (or a Creditworthy Cosigner)

Since private loans are risk-based, lenders will evaluate:

-

Your credit score and credit history

-

Your debt-to-income ratio

-

Whether you have a cosigner with strong credit (especially for undergraduates)

Most students will need a cosigner to qualify or to access lower interest rates.

✅ Tip: Many lenders allow you to prequalify with a soft credit check—so you can view rates without impacting your score.

4. Proof of Income or Employment (for Some Borrowers)

Graduate students, independent borrowers, and cosigners may need to provide:

-

Recent pay stubs or W-2s

-

Tax returns (especially for self-employed borrowers)

-

Employment verification

This helps lenders assess your ability to repay the loan after graduation.

5. Age and Legal Requirements

You must be:

-

At least 18 years old (or the age of majority in your state)

-

Legally able to enter into a loan contract

How to Apply for a Private College Loan

Once you’ve decided that a private student loan is right for you, the application process is fairly straightforward—but requires attention to detail. Follow these steps to ensure a smooth, successful experience.

Step 1: Prequalify and Compare Lenders

Start by shopping around and using prequalification tools offered by many lenders. These tools let you:

-

Check your estimated interest rates and terms

-

Compare lenders without affecting your credit score (soft pull)

-

Determine whether you need a cosigner

✅ Tip: Use comparison platforms like Credible or LendKey to review multiple offers at once.

Step 2: Submit Your Application

Once you choose a lender, complete the online application. You’ll need to provide:

-

Personal information (SSN, address, phone, email)

-

School details (name, degree program, enrollment status)

-

Loan amount requested

-

Financial details (income, housing, employment)

-

Cosigner’s information (if applicable)

Most applications take 15–30 minutes to complete.

Step 3: Upload Required Documents

You may need to submit:

-

Government-issued ID (driver’s license or passport)

-

Proof of income (pay stubs, W-2s, or tax returns)

-

School enrollment verification or class schedule

-

Cosigner documents (if required)

Promptly uploading your documents speeds up approval.

Step 4: Wait for Loan Approval

Once submitted, your application will undergo review. This may take:

-

Minutes to a few days for pre-approval

-

1 to 2 weeks for final approval and certification

The lender may contact you for additional information or clarification during this stage.

Step 5: School Certification and Loan Disbursement

After approval, your lender will contact your school to certify your loan. This ensures:

-

You are enrolled

-

The loan amount doesn’t exceed your cost of attendance

Once certified:

-

Funds are sent directly to your school to pay tuition and fees

-

Any remaining balance may be refunded to you for housing, books, or other expenses

This final step can take 1 to 3 weeks, so apply early to avoid delays.

Pros and Cons of Private College Loans

Before committing to a private student loan, it’s important to understand the advantages and disadvantages. While private loans can help bridge financial gaps, they’re not always the best first option.

✅ Pros of Private College Loans

1. Can Cover Full Cost of Attendance

Private loans can be used to cover up to 100% of your certified cost of attendance, including tuition, housing, books, and other education-related expenses.

2. Competitive Interest Rates (for Qualified Borrowers)

If you or your cosigner has strong credit, you may qualify for lower interest rates than federal PLUS loans or unsubsidized graduate loans.

3. Flexible Loan Terms and Repayment Options

Many lenders allow you to choose between 5, 10, or 15+ year repayment terms, and offer various repayment options (deferred, interest-only, immediate).

4. Fast Application and Approval Process

Unlike federal aid, which depends on FAFSA timelines, private loan applications are available year-round and are often approved in days.

5. Extra Benefits and Discounts

Some lenders offer autopay discounts, loyalty perks, or career support programs like job coaching and financial literacy resources.

❌ Cons of Private College Loans

1. No Access to Federal Protections

Private loans do not qualify for income-driven repayment, Public Service Loan Forgiveness (PSLF), or federal forbearance and deferment programs.

2. Credit-Based Approval

Most students need a cosigner to qualify or secure better interest rates, which can be a barrier for some borrowers.

3. Variable Interest Rates May Rise Over Time

Variable-rate loans can start low but increase significantly, making your monthly payments unpredictable and more expensive.

4. Fewer Hardship Options

While some lenders offer temporary forbearance, private loans offer less flexibility during financial hardship compared to federal loans.

5. Cosigner Responsibility

If you default on your loan, your cosigner is legally responsible for repayment, which can strain family relationships or credit histories.

Bottom Line:

Private college loans can be a smart option if you’ve exhausted all federal aid and understand the terms. However, they require careful comparison and responsible borrowing to avoid long-term financial challenges.

Private Loans vs. Federal Student Loans: Which is Better?

When it comes to funding your college education, understanding the differences between private loans and federal student loans is essential. Each has its own advantages and limitations, and the best choice often depends on your financial situation, credit profile, and long-term goals.

Side-by-Side Comparison

| Feature | Federal Student Loans | Private Student Loans |

|---|---|---|

| Lender | U.S. Department of Education | Banks, credit unions, online lenders |

| Credit Check Required? | No (except PLUS loans) | Yes |

| Interest Rates | Fixed and lower for most borrowers | Fixed or variable; credit-based |

| Repayment Plans | Income-driven, standard, graduated | Limited options; often fixed-term |

| Loan Forgiveness Available? | Yes (PSLF, IDR forgiveness) | No |

| Subsidized Interest Option | Yes (for eligible undergrads) | No |

| Deferment/Forbearance | Generous options | Limited, varies by lender |

| Cosigner Required? | No | Usually, unless you have strong credit |

| Borrowing Limits | Capped per academic year and degree level | Can cover full cost of attendance |

✅ When Federal Loans Are the Better Choice

-

You qualify for subsidized loans, which save money on interest while in school

-

You need income-driven repayment or forgiveness programs

-

You want access to deferment, forbearance, or loan rehabilitation options in case of financial hardship

-

You don’t have a credit history or cosigner

✅ When Private Loans May Be a Better Fit

-

You’ve maxed out federal loan limits and still need funding

-

You or your cosigner has excellent credit and can secure a lower interest rate

-

You’re pursuing graduate or professional school, and your career path offers high earning potential

-

You want custom loan terms or are looking for fast disbursement

Expert Tip:

Always fill out the FAFSA and review your federal aid package before applying for private loans. Even if you think you won’t qualify for much, federal loans offer unmatched flexibility and protection.

Smart Tips for Borrowing Private Student Loans

Taking out a private student loan is a serious financial commitment. To avoid unnecessary debt and future stress, it’s important to borrow wisely. Here are some smart tips to help you make the best decision when exploring private college loan options:

✅ 1. Compare Multiple Lenders

Interest rates, fees, and repayment terms can vary significantly between lenders. Use comparison tools like Credible, LendKey, or NerdWallet to:

-

View side-by-side offers

-

Check rates with a soft credit inquiry

-

Identify lenders that best match your needs

✅ 2. Use a Cosigner if Needed

If you have little or no credit history, applying with a creditworthy cosigner can:

-

Improve your chances of approval

-

Help you qualify for a lower interest rate

-

Reduce overall loan costs over time

Make sure your cosigner understands their responsibility—they are equally liable for repayment.

✅ 3. Choose Fixed Interest Rates (When Possible)

Fixed rates offer predictable monthly payments and protect you from rising interest over time.

Variable rates may seem attractive upfront but can increase with market conditions, potentially raising your total repayment amount.

✅ 4. Borrow Only What You Need

Don’t treat private loans as extra spending money. Calculate your actual cost of attendance, subtract grants, scholarships, and federal aid, and borrow only the necessary amount.

Remember: Every dollar you borrow today will cost more with interest tomorrow.

✅ 5. Understand Your Repayment Terms Before You Sign

Before accepting a loan offer, review:

-

When your first payment is due

-

What repayment plans are available

-

Whether there’s a grace period

-

Any penalties or fees for early payment

✅ 6. Look for Autopay and Loyalty Discounts

Many lenders offer a 0.25% interest rate discount if you set up automatic payments. Others provide perks for being a returning customer or having another account with the bank.

✅ 7. Reevaluate Each Year

You don’t have to stay with the same lender annually. Shop around for better rates or terms before borrowing each new school year—and consider refinancing after graduation if your credit has improved.

Borrowing smart is about balancing your immediate college needs with long-term financial health. The right private loan, chosen carefully, can support your education without overwhelming your future.

Alternatives to Private College Loans

Before taking on private student loan debt, explore these alternative funding sources that may reduce or eliminate the need to borrow:

Scholarships and Grants

-

Free money that doesn’t need to be repaid

-

Offered by schools, nonprofits, businesses, and government agencies

-

Use scholarship search tools like Fastweb, Scholarships.com, and Cappex

Work-Study or Part-Time Jobs

-

Federal Work-Study programs provide on-campus or related part-time jobs

-

Part-time employment can help cover living expenses and reduce loan dependency

Tuition Payment Plans

-

Many colleges offer monthly payment plans that let you spread tuition over the semester or year

-

Often interest-free, helping you avoid interest accrual

Family Loans or Contributions

-

Family members may be able to assist informally or through low-interest agreements

-

Set clear repayment terms to avoid misunderstandings

Income Share Agreements (ISAs)

-

Offered by some schools or private funders

-

Instead of paying upfront, you repay a fixed percentage of your income after graduation for a set time

Exhaust all non-loan options before borrowing privately to reduce long-term debt.

FAQs (Optimized for Featured Snippets)

Here are some frequently asked questions about private college loan options, optimized for visibility in search engines:

Are private college loans better than federal loans?

Not usually. Federal loans offer lower fixed interest rates, flexible repayment plans, and forgiveness programs. Private loans can be useful when federal aid isn’t enough, but they come with fewer protections.

Can I get a private student loan without a cosigner?

Yes, but it’s difficult. Most undergraduates need a cosigner unless they have excellent credit and income. Some lenders, like Ascent, offer no-cosigner options for eligible students.

What is the minimum credit score for a private student loan?

It varies by lender, but most require a credit score of at least 650–700. A cosigner with a higher score improves your chances of approval and a lower interest rate.

Do private student loans cover living expenses?

Yes. Private loans can be used for any education-related costs, including housing, food, transportation, and supplies, as long as they’re within your school’s certified cost of attendance.

Can I refinance my private student loans after graduation?

Yes! Many borrowers refinance to get a lower interest rate, consolidate multiple loans, or remove a cosigner. Good credit and stable income help you qualify for better terms.

Conclusion

Private student loans can be a valuable tool for funding your education—when used wisely. They offer flexibility, quick access to funds, and can help cover gaps left by federal aid. But they also come with risks and responsibilities.

✅ Before borrowing privately:

-

Always apply for federal aid first

-

Compare multiple lenders

-

Understand your repayment obligations

-

Borrow only what you truly need

Whether you’re an undergrad, graduate student, or parent, choosing the right private college loan option starts with doing your homework and planning ahead.

When in doubt, talk to your school’s financial aid office—they can help guide you through your options and steer you toward smarter borrowing.